Dreaming of a

Debt-Free Christmas?

This One’s For You

Emma Bowdler

I’m a cheerleader for women and an accountant bursting with personality.

The vast majority of women we know are generous, giving creatures who love to spoil their nearest and dearest, especially during the festive season. And regardless of how much we vow to ‘rein(deer) it in’ or how long in advance we plan, we have all fallen victim to the spending vortex that is Christmas (or your cultural equivalent).

While the economy certainly lights up, it’s not great for our bank balances and it’s also not what the holidays are truly about. We have put together a few helpful tips from budgeting to buying ethical to make sure the tinsel on your tree is the only thing in the red this Christmas.

1. Identify What’s Motivating

Your Silly Season Spending

The good (or bad) thing about the festive season is that it happens at the same time every year – and that means we know it’s coming and we can plan ahead. Being finance chicks, we love a good budget, but before we dive into that, the best place to start when trying to achieve a debt-free festive season is by Unpacking Your Money Story.

We all have truths that we tell ourselves, beliefs and assumptions that dictate our actions or influence our decisions. The same goes for our money. While having a money story isn’t a ‘bad’ thing (thank goodness because we’ve all got them), knowing what yours is and how it translates into spending decisions at this time of year is really helpful in reorienting your mindset. A few questions to reflect on:

- What were the conversations about money and Christmas that I picked up as a kid?

- What are some of the ways that the media and social media portray Christmas giving that could have influenced me?

- How do I see debt and what’s ‘worth’ going into the red for?

- What role does money play in the way I show people I care about them?

- How would a Christmas without the bells and whistles make me feel?

These are great questions to ask yourself before you start creating a budget for the festive season. With a deeper understanding of truly what money means to you and how you show people you care about them, it will become much easier to set parameters for a successful budget.

READ: Unpacking Your Money Story

2. Create a Vision Of What a Debt-Free Christmas Could Bring You

Many of us harbour a mixed bag of feelings, anxiousness; stress; generosity; love, when it comes to the festive season. It is for this very reason that we recommend you give some thought to what version of a debt free Christmas is right for you. Debt is not always monetary, emotional debt is a thing too! Combining these two debts is an almost guaranteed way to rain on your own parade. We have all fallen victim to the trap of purchasing expensive presents because of the expectations others place on us, or maybe that we place on ourselves. If a debt-free Christmas means filling your stockings with friends and family rather than gifts, that’s okay. Sometimes all we need is a little music, and good company.

Being ethical about our spending choices during this time can often help us find more meaning, especially when it comes to giving gifts. Ethical in this case refers to what we are purchasing, as well as treating our bank account with respect. We don’t mean to sound like anyone’s mum here, but often the most meaningful/impactful gifts are thoughtful ones. We suggest the following. Think about how you want to feel towards the end of the year when it is all said and done, work backwards from there. Create your debt-free Christmas in that image. Big ticket items will often crumble under the weight of thoughtfulness. Even better if your gifts are responsibly sourced.

3. Unpack What Gets in the Way of You Sticking to a Budget

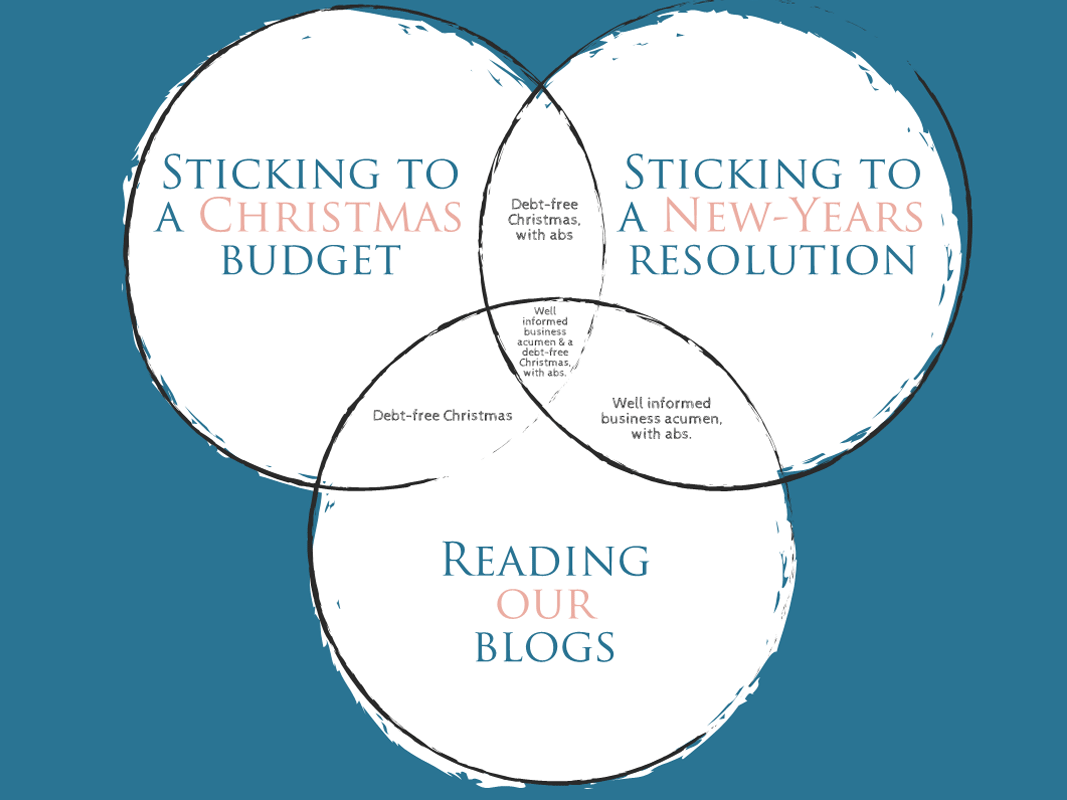

Let’s be honest – the venn diagram of those who’ve made New Year’s resolutions and who’ve broken New Year’s resolutions is a circle.

The same goes for budgeting! So, before you go to the effort of creating a Christmas budgeting, it’s time to have a think about what’s going to get in the way of you sticking to one.

The way we see it, people stray from their budgets for several key reasons:

1. It’s unrealistic and therefore sticking to it is not practical or possible.

2. It’s too complicated or you don’t have visibility of the really important numbers – budgets don’t have to be complex, they can be simple and they need to include expenses across different time horizons such as weekly, monthly and yearly.

3. The budgeting process hasn’t been given enough time, or been revised – like most good things in life, budgets take time! It is also not a static process, but rather something that needs to be updated and changed when your circumstances do, so don’t cast it in stone.

4. It isn’t written down – having your budget written down, in hard copy if necessary, is one of the most important things you can do to stick to it successfully. Without proper records, how can you know what is working and what is not? It may seem like a pain at first, but once you get into the flow of jotting it all down you might even find yourself enjoying it! Recording important information like this not only helps us find trends and patterns we can use to improve but assists our brains in archiving what is important. There is a flow on effect at play here, better informed people make better decisions. It’s that simple.

5. Planning kills your excitement – we get it, Christmas is meant to be joy-filled, footloose and fancy-free and a budget really hushes the buzz. We understand that budgeting can take away some off that exciting spontaneity out of the silly season, but hoping to be debt-free this Christmas without a budget is futile. Write down your end goal, to remind yourself of why you started, and place it somewhere you’ll see it every day. This will help keep the excitement for the future high and the reminders of why you started frequent.

So, what’s your budget barrier? And how are you going to jump the hell over it?

4. How to Sleigh Your Christmas Budget, As Your Presents is Required!

Unlike a “regular” budget, your Christmas budget is likely going to be short-lived, and as each year goes by, you’ll get better and better at it. Make a list (and check it twice) of all the things you need to spend on at this time of year such as gifts, food and drink, travel or accommodation, outfits.

Figure out how much of your cash-flow can be diverted to your Christmas budget without spending beyond your means. Before you even think about it, credit cards and BNPL are not the answer! Not only do the retailers lose out on revenue because of fees, but you’ll be left paying it off for months. Budgeting is the answer!

Here we have a simplified example. Starting with your cashflow, categorise your spending into simple macro elements (Bills, Savings, Play, Emergency). This will help you understand where your money is going. Now simply figure out if there is surplus anywhere, if there is we plug it back into savings and we are done… Don’t worry we are just kidding.

Now back to the real world, what if the surplus isn’t obvious or maybe there isn’t any surplus? Which category could use a diet? This is a subjective process that you may not get 100% correct the first time and that’s okay. At this point we create a fifth category (Bills, Savings, Play, Emergency, End of Year). Now we must play hard ball, which entire category (or parts of a category) are non-essential for the short-term? This is where our Christmas fund will be coming from. We move that cash into our End of Year category, and we are well on our way to a debt-free Christmas.

5. It’s the Most Wine-Derful Time of the Year, Don’t Forget to Reflect

We promise that’s the last pun, but the point stands. It’s easy to get caught up in the busyness and chaos that the silly season brings. It’s an equally useful as it is wholesome activity to take some time to reflect on your end of year, particularly when it comes to your spending. Ask questions like; Was my budgeting accurate? Did I spend what I thought I would, if so was it more or less? Were people happy? Was I happy?

This kind of reflection will help you plan more successfully for next year, by finding out what works and what does not. Remember, a debt-free Christmas is about much more than money.

So, there you have it. Five sizzling tips to keep you debt-free and stress-free this festive season. With a new money mindset, greater clarity on what you’re going to spend and why, as well as a contingency plan for that ‘emergency’ gift for your cousin’s ex-husband’s colleague at the family Kris Kringle, you’ll be well on your way to celebrating what actually matters at this time of year.

If you’d like some help to refine your budgeting skills or even to build them from the ground up. Reach out, you know we are professional money people right?

Struggling For Momentum? If You’re Doing Any of These, *You* Might Be the One Holding Your Business Back

Struggling For Momentum? If You’re Doing Any of These, *You* Might Be the One Holding Your Business Back Five self-sabotaging mindsets and behaviours preventing business owners from achieving profitability, sustainability and impact (and what to do instead). Emma...

Are You Growing Broke? Why Scaling Your Business Might Be Shrinking Your Profits (and What to Do About It)

Are You Growing Broke? Why Scaling Your Business Might Be Shrinking Your Profits (and What to Do About It)The sneaky trap where revenue rises but margins disappear. Here’s how to protect your profits and your peace before you get yo’self into a financial pickle. Emma...

Stop Making These Tax Time Mistakes (and What to Do Instead)

Stop Making TheseTax Time Mistakes(and What toDo Instead) You work too hard to let tax time drain your energy (or your bank account). Avoid these common business tax mistakes before you leave more money on the table. Emma BowdlerI’m a cheerleader for women and an...