Are Christmas Gifts

To My Clients Tax Deductible?

Emma Bowdler

I’m a cheerleader for women and an accountant bursting with personality.

Ask any accountant worth their salt and one of the most common questions we get asked during the festive season is: “are these gifts to my clients and staff tax deductible, including my work Christmas party?”. From fringe benefits tax to that all-important boozy Christmas break-up, we have all the answers to those questions and more.

You might be asking: ‘Em, we know you’re helpful but why are we going to all this trouble to avoid FBT. The baseline FBT rate is a whopping 47%, you probably don’t need us to do the math on this one. So, peel those prawns and let’s get into four of our favourite festive season FAQs!

What the Hell is Fringe Benefit Tax and Does it apply to Buying Gifts?

There are two key things we need to understand when it comes to deducting gifts from our taxable income: Minor Benefits Exemption (MBE) and Fringe Benefits Tax (FBT). Well aren’t they some fun little acronyms that roll easily off the tongue…not exactly, but let’s start by defining what a fringe benefit is (and no it doesn’t have anything to do with the haircut you gave yourself during lockdown):

→ A ‘benefit’ is defined by the ATO as any rights, services, or privileges provided to an employee by an employer.

→ A ‘fringe benefit’ is a ‘payment’ given to an employee, but in a different form to salary or wages.

A little clearer? Basically, the most common example of a ‘fringe benefit’ is when an employer (i.e. you) provides an employee (e.g. Karen in Sales) with a discount (i.e. a ‘benefit’) or full payment for a gym membership (a ‘fringe benefit’). Another example would be the company car!

Now, before we dive into the tax part of fringe benefits, let’s tackle MBE. According to our friends at the ATO (probably less friends than acquaintances we see a few times a year because we have to):

→ A ‘minor’ benefit is any benefit (remember your definition from above) that has a value less than $300

This dollar figure is important because it’s what the ATO considers as unreasonable to tax. There are of course some rules around how regular or seemingly ‘beneficial’ the gifts are, but your accountant should be all over that. (If you have any questions, always feel free to drop The Women’s Accountant a line!)

Now we have some of the lingo down, we can define FBT as a tax paid by an employer on certain benefits they provide to their employees, clients, or their employees’ family (associates). In this case when we say employee, we mean anyone who; is a current, future, or past employee; director of the company; or a beneficiary of a trust who works in the business.

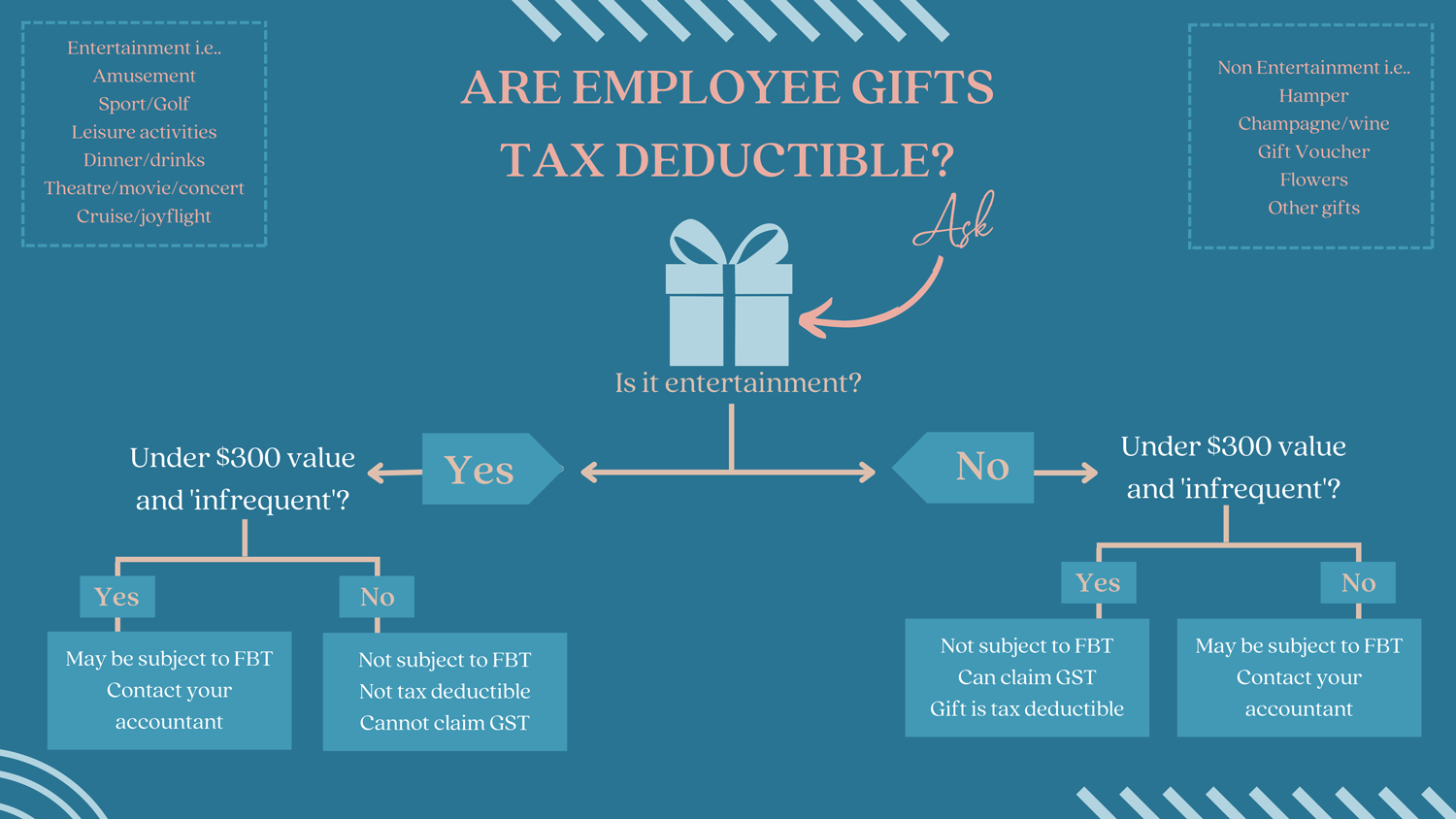

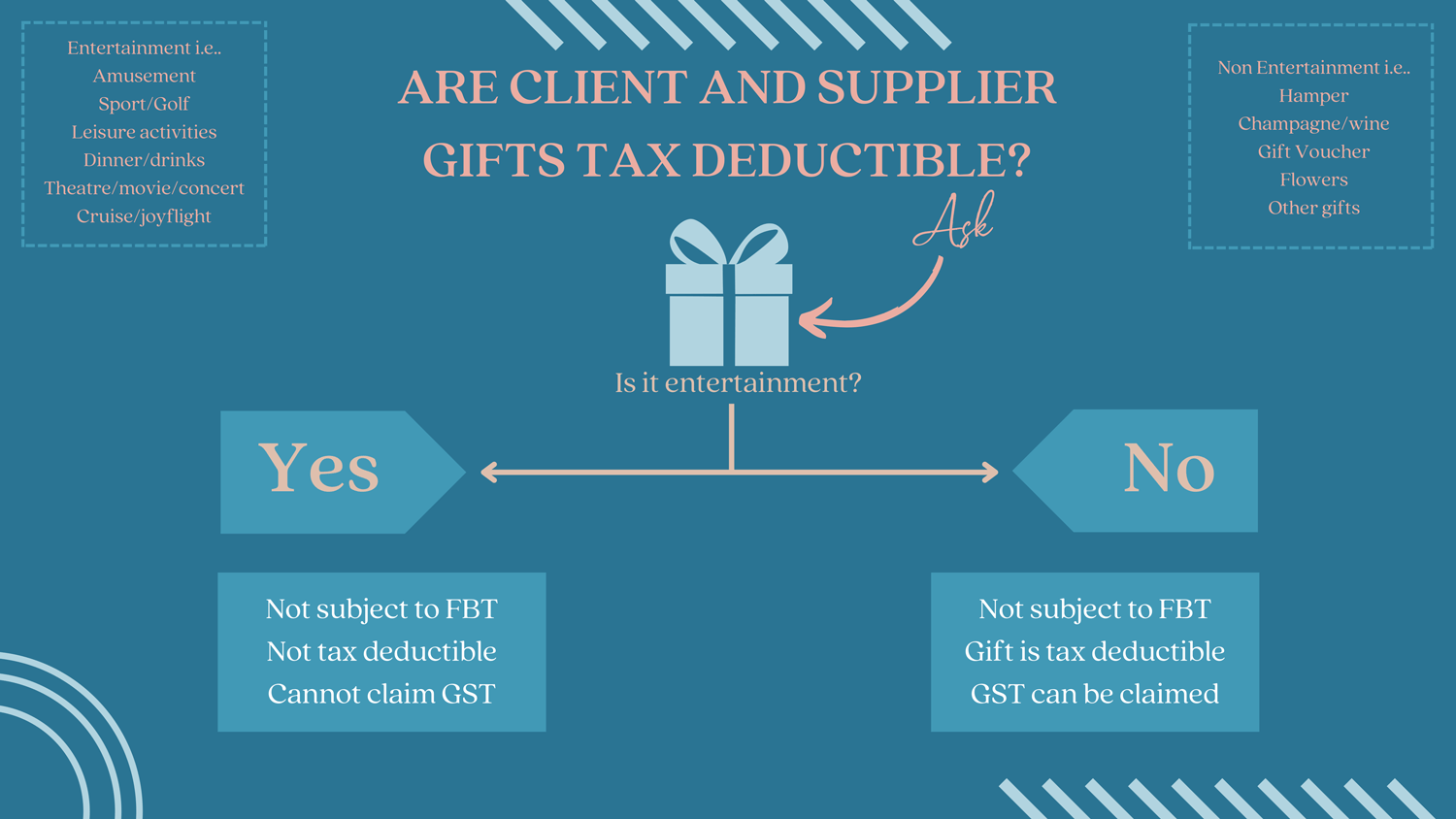

Any benefit that satisfies the above rules and is under $300 is exempt from FBT as it qualifies for MBE. The ATO provides a detailed description of fringe benefits that are exempt from FBT. So… any gifts that you buy for; clients; employees; or their associates, through your company, are considered benefits and as such may be subjected to tax or exemption depending on the gift and its context.

What Kinds of Gifts are Exempt From Fringe Benefits Tax and Can I Buy Booze?

Unless reading through a 15,000-word ATO webpage sounds like a super good use of your precious time, we are going to save you the trouble and give you a list of our mostly commonly asked for items.

As a general rule, gifts that are usually exempt from FBT are things you give once a year that are less than $300 and aren’t used for ‘entertainment’ purposes. Think: flowers, body lotion, hampers, accessories, even alcohol (yes, you heard that correctly, a champagne breakfast can sometimes be FBT exempt, grab the bottle opener).

- A once-off end of year bottle of wine to your employees? Exempt.

- A bottle of wine every Friday to celebrate the week? Not so much.

- A bunch of flowers once a year on their birthday? Exempt.

- A bunch of flowers every fortnight to brighten their home? Not so much.

We’ve got ahead and made two simplified flowcharts with some generic examples to help you out!

What if My Gift is More Than $300?

If you’re feeling particularly generous this year, you can certainly buy gifts that are more than the $300 dollar threshold. Please, don’t let us stop you! It just has further implications when it comes to tax deductions but we recommend you leave that to the professionals.

What Kind of Gifts are Not Exempt from FBT?

The general rule here is, gifts that are ‘entertainment’ such as live music concerts, tickets to sporting events, even flights and accommodation (you know, all the really fun stuff) are neither FBT exempt, nor qualify for MBE. The main reason is that they are considered to provide personal benefit and therefore cannot be claimed as a tax deduction.

If you would like some further reading the ATO has a list of what does not count as a fringe benefit, and a list of what benefits do not qualify for MBE.

A Little Party Never Hurt Nobody, Right?

Christmas parties (or other office parties) do actually fall under the category of ‘fringe benefits’, and therefore attract both MBE and FBT. Similar to ‘entertainment’ and ‘non-entertainment’ gifts, parties or gatherings have to fit within some pretty strict guidelines, but with a few added ingredients for extra flavour. Mainly ‘the exempt property benefit’. That means, the ‘costs’ related to hosting a Christmas party such as food and drink are exempt from FBT, if they are provided on a working day; on the business premises; and enjoyed by current employees only, not associates or clients. By the way, the ATO definitions of associates are pretty broad. But in this case, we are generally referring to; family members; spouses; and trustees.

The minor benefit exemption applies to your Christmas shindig (or any other infrequent shindig) if the cost is less than $300 per head, even if you give a gift as well.

For example, if you throw a Christmas party at a venue that costs $180 per head for each employee aaaaand you also give those employees a super generous hamper worth $225 at the same event, both of these ‘fringe benefits’ are considered to be minor and therefore exempt.

We hope that’s gotten you to being well on your way to avoiding any unnecessary taxes this Christmas. As much as we need taxes in society, no one wants to be paying more tax than they should be.

If on your list is the most tax-free Christmas possible for your business, you know we are professional tax people, right? Book your free Business Growth Session with The Women’s Accountant today and we’ll be sure to answer any FBT, MBE, WTF questions you have!

Automate, Delegate, Rejuvenate – Systems and Processes Every Business Needs

Automate, Delegate, Rejuvenate: Systems and Processes Every Business Needs Emma BowdlerI’m a cheerleader for women and an accountant bursting with personality. Close your eyes (ok, well not *literally* because you need to keep reading), and picture: an entrepreneur....

Numbers to Nail for Every Woman In Business 💅

Numbers to Nail for Every Woman In Business 💅 From profit margin to cash flow, master these key metrics and put yourself in the driver’s seat to business profitability, freedom and sustainable growth. Emma BowdlerI’m a cheerleader for women and an accountant bursting...

Feast or Famine: Dealing with the Ebbs of Business Cash Flow

Feast or Famine: Dealing with the Ebbs of Business Cash Flow Cash flow lumpier than your mother-in-law’s gravy? You’re not alone. Let’s talk ‘feast or famine’ cycle and how to manage your cash flow. Emma BowdlerI’m a cheerleader for women and an accountant bursting...